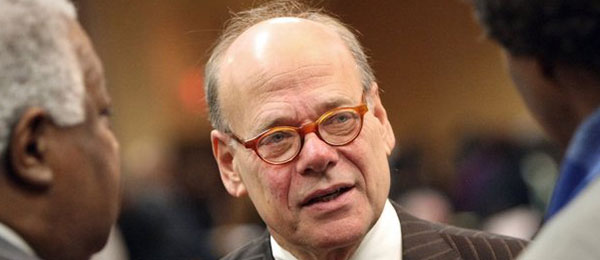

The Commercial Appeal sat down with Congressman Steve Cohen for a Q&A about his bill targeting predatory lenders.

Excerpt:

Q: You filed this bill last year, but it did not pass. Why has Congress been reluctant to pass such legislation?

A: Generally, payday lenders have got a lot of political support. They’ve got friends in high places. You might think they’re shady, but they’re business people. They are wealthy. Sometimes having money gives you the appearance of respectability, independent of how you make that money.

Q: What are the bill’s prospects?

A: I would think it’s doubtful. Consumer bills have not fared well with the Republican Congress. Republicans are always concerned about business, and I don’t know any bill since I’ve been up there that I’ve seen that has been scheduled for a hearing or a vote that dealt with consumer issues.

Q: President Obama talked in Birmingham last week about the need to regulate payday lenders who take advantage of consumers in need of quick cash. Is this idea finally gaining some traction?

A: I think it’s got traction with the people who have concerns for fairness and justice and fair play.

Q: Who is really at the heart of this business, big corporations or smallish entrepreneurs?

A: They’re not smallish. You’re talking extremely wealthy people who have made a ton of money. There are some businesses I know of here in Memphis — fine, upstanding citizens, who are members of the most elite clubs, who’ve got businesses that basically deal in this area.

They make the same arguments, ‘Well, if we didn’t have these (loans), poor people wouldn’t have access to capital.’ Well, they’re not real worried about giving poor people access to capital.

They’re interested in ripping off poor people and making more money to pay their country club dues or just having more money, because none of them need the money.

Q: What do you expect the industry will do to alter or impede your legislation?

A: I’m sure they’ll talk to the relevant committees and make sure it doesn’t come to a vote. As I said, I haven’t seen the Republican chairs have any interest in consumer legislation the entire time they’ve been here. So they (the industry) probably will just continue to go and support the Republican caucus and the Republican funds.

Q: Why are there so many payday and title pawn shops in the Memphis area?

A: Poor people have no access to banking, no credit, no history of credit, no real property to pledge. They don’t have access to capital in the usual since.

Historically, pawn shops kind of served this group. At least with pawn shops, there were regulations, and there were some limits. I don’t think pawn operators really took advantage of people like the payday lenders do.

Q: Lots of people rely on these businesses to get by when they are tight for money. Will this legislation make it more difficult for people to get credit?

A: In North Carolina, when they passed legislation that tied the interest rates and kind of tied these people down, people had more access to getting credit, so it didn’t happen there. There are no studies to show they will have less access to credit. There are other more trustworthy credit lenders that will surface and maybe supply the need.

Q: Why did Congress, in 2006, enact the interest rate cap just for military service members and their families instead of for the public at large?

A: They saw all of these properties spring up around military bases. But if ripping off veterans is wrong, and it is, then ripping off John Q. American Citizen is wrong.